Did you know that blockchain tokenization has changed the way we invest in real estate?

Real estate tokenization is the process of creating a virtual token to represent ownership of a real estate interest. Rather than using traditional paper or e-documentation, purchasers, lessees, mortgage lenders, and mortgage-backed security (MBS) investors can receive a cryptographic digital token representing their ownership in a property.

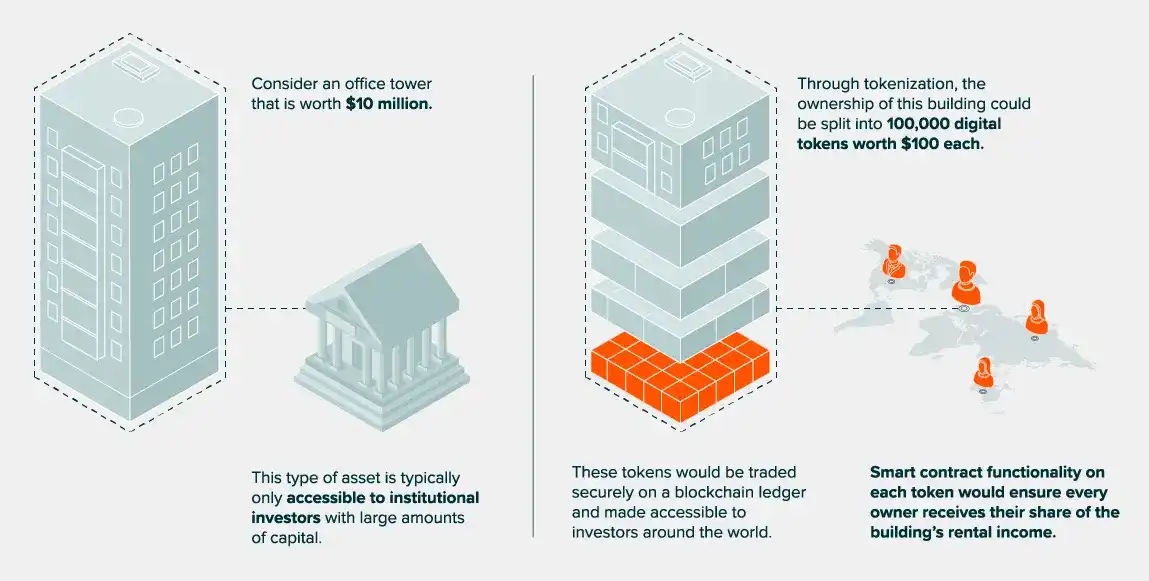

In this graphic, we visualize how tokenization could be used in real estate.

Benefits of Real Estate Tokenization

There are several ways that tokenization of real estate assets can benefit both buyers and sellers. Here are some of the benefits of real estate tokenization.

Low Barrier to entry – Normally, investing in real estate holdings requires a large amount of money, either immediately or through EMI over a long period of time that might last decades. However, because of fractionalization, even a small first-time investor may own security tokens in many properties anywhere in the world.

Fractionalization – As with any real estate transaction, a large initial deposit is required; but with property tokenization, fractionalizing the property into little parts makes it available to even small investors. Details of each owner are securely stored and managed on the blockchain.

Reduced Settlement Time – Unlike traditional real estate transactions, which might take days, weeks, or even months to resolve, tokenized assets can be finalised very instantly.

Liquidity – One of the most important benefits of real estate tokenisation is the availability of infinite liquidity in an otherwise industry that is notorious for being an illiquid business investment.

Automation – Because of the inherent benefits of blockchain technology, everything is automated via smart contracts. From legal compliance through document verification to trading and dividend distribution to purchasers, all processes are automated.

Data Transparency – Because blockchain technology is used, every step in the tokenization process is transparent; even the money gathered through property tokenization is directly invested into real-world property, and the token issuer does not get to retain the money.